Want to hear from us?

Sign up to receive our latest email news, offers and updates.

News and Events

November 08, 2023#

Leading American companies to rely on strong R&D strength and financial strength to implement multi-brand strategies

Industry leaders in the US pet food market led by Nestle, Mars, J.M.Smucker, etc.

Features: Large platform, wide business scope, mature sales channels, and high corporate awareness. They have a complete range of products and wide coverage, covering the low, medium, and high-end markets, and have a significant share in each market segment.

On the one hand, their R&D strength is strong.

They have long been committed to pet nutrition and health research and developed various pet food brands. These companies usually have research centers dedicated to pet health, studying pets' dietary needs and preferences to help improve pet nutrition and health.

On the other hand, they are financially strong and implement a multi-brand strategy.

They will acquire mature pet brands, and the acquisition targets generally have their own relatively mature sales channels and customer sources. In addition to the platform effect of the acquirer, the two parties have complementary advantages. For example, since 1935, Mars has successively acquired more than ten companies and brands. The targets of mergers and acquisitions are not only limited to the field of pet food but also cover the fields of pet medical care and pet technology, which has promoted the optimization of Mars' product lines, market segmentation and Expansion of sales channels.

Content-based companies mostly implement differentiated strategies with market segments as the entry point.

Blue (mainly natural food) and Hills (mainly prescription food) are typical content-based companies. Although their products are relatively simple, they are usually single-brand and multi-series, covering different types of dog food, cat food, dry and wet food, etc., and each product line has subdivided products for different pets' life cycle, taste, function, and preference to meet different needs. At the same time, in order to emphasize product positioning, the channel matching of such enterprises is more refined. For example, natural food is mainly sold in pet stores and large chain pet supermarkets, and prescription food is mainly sold in hospitals and clinics, supplemented by marketing methods to enhance brand awareness and customer group stickiness.

Multiple factors have made the United States the world's largest pet market

1. The establishment of the factory system makes it possible to mass-produce pet food by machine.

Before commercial pet food, pet owners mainly fed their pets with human food and leftovers. In 1860, James Spratt invented the first commercial pet food, and then a public company took over the formula and put it into production in the United States. Other companies also began to develop their own pet food to join the market competition. The first industrial revolution led to the widespread realization of large-scale machine production and the factory system in the United States. Pet food produced by mass production and machine processing is cheap and easy to eat, and is increasingly attractive to busy urban consumers. In the 1950s, researchers in Purina's laboratory invented the extrusion process, puffed pet food appeared, and the digestibility and palatability of pet food increased, and pet dry food became more popular.

2. The rapid economic development promotes people's willingness to keep pets and the level of consumption.

After the completion of the second industrial revolution, the U.S. economy developed rapidly. From the 1970s to the early 21st century, the U.S. per capita GDP grew rapidly, per capita disposable income increased, and the public’s spending power increased. In the mid-1970s, the per capita GDP of the United States exceeded 8,000 US dollars and continued to grow rapidly. The pet industry entered a stage of rapid development. At this stage, the penetration rate of pet-raising households in the United States continued to increase. According to APPA data, from 1988 to 2008, the number of pet-raising households in the United States Penetration increased from 56% to 62%. In addition, the increase in living space is also a driving factor. Larger living space means more favorable breeding conditions, increasing people's willingness to keep pets (which also explains the preference for large dogs in American families). The American people prefer to keep large dogs, and larger living space means more favorable breeding conditions. From the 1970s to the early 2000s, the proportion of single-family houses in the newly built private houses started every year in the United States increased from about 55% to 100%. About 80%, the increase of residential living area is more conducive to pet raising and accelerates the scale growth of the pet commodity industry. In addition, during this period, platform-based companies represented by Mars and Pinpu entered the pet food market through full-chain acquisitions and integrated upstream and downstream. Pet food storage hypermarkets also began to emerge in the United States, and pet food sales channels Expansion, industry leaders began to form, prompting the rapid expansion of the pet food industry.

The trend of "humanization of pets" drives the transformation of pet products to the direction of "humanization". Beginning in the mid-1970s, pets began to be endowed with the attributes of "people" in the family, and were gradually regarded as "children" or "spouses" in the family. The more pets provide the abundant product. People's affection for pets is deepening day by day, and pet owners' lifestyles are reflected in pets, which promotes the in-depth development of the pet food industry. For example, pet owners pursue natural and organic diets, so pet food has also begun to have the same requirements. Growing interest in quality pet care among pet owners and escalating consumer demand has led to the emergence of food products and “premium” brands targeting specific life stages, physiological states and disease states. In addition, the development of the pet food industry at this stage is closely related to the degree of aging. From 1970 to 2005, the population of the United States aged 65 and over increased from about 20 million to about 36 million, and the degree of aging continued to increase.

Several Key Opportunities for Growth in the U.S. Pet Food Industry

Several key opportunities for U.S. pet food industry growth in 2020 and beyond:

1. The increase in the number of pets

"Besides premiumization, one of the biggest pet food market drivers is the growth in the number of pets, so even with the negative economic impact of the pandemic, the increase in adoption rates points to continued sales growth," said the head of Packaged Facts. Food marketers and retailers will be well-positioned to target new pet owners and ensure their long-term loyalty from day one with 'puppy promotions' and a new pet welcome program."

2. Prefer to buy low-cost pet brands

As the economic fallout of the pandemic continues and millions of pet owners face the threat of financial strain, a switch to low-cost private-label pet food seems inevitable.

Packaged Facts found that increased consumer awareness of value has resulted in private label promotion in many categories. Private-label contract manufacturers and retailers that sell brands will likely benefit in the months and years to come.

3. Pursue the next "natural" logo

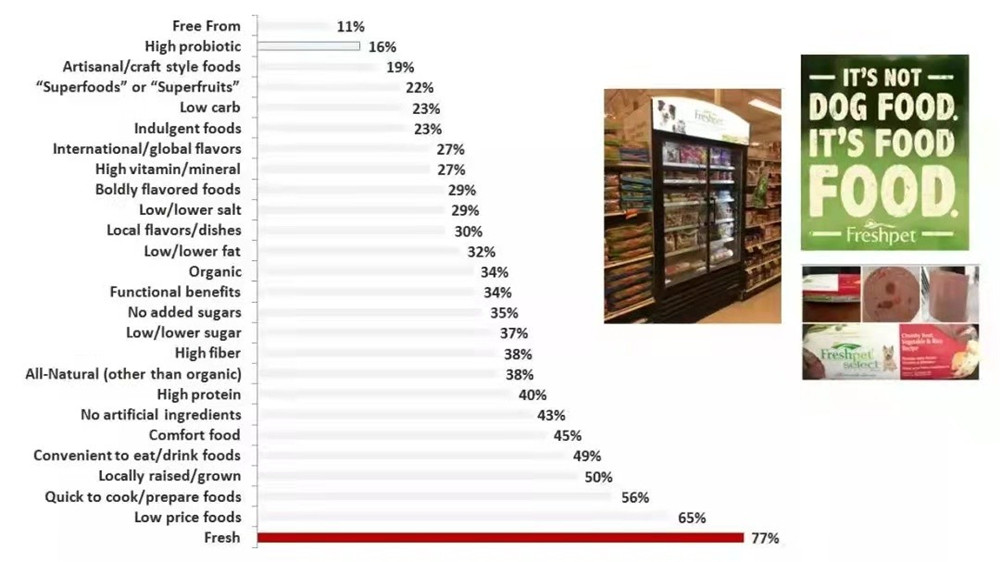

"Natural" has long been one of the top appeals for top pet foods. But with natural formulations now ubiquitous in the pet food market, the days of relying on the "natural" claim to sell pet food are dwindling, forcing marketers to be creative in finding equally attractive options. As a result, "fresh," "limited ingredients," and "superfoods" have all gained traction, as have foods with exotic and alternative proteins.

#caroline@chaotaipet.com

#whatsapp:+8615725288425

Want to hear from us?

Sign up to receive our latest email news, offers and updates.